How We Created an Autonomous Credit Facility

with Opus

Try it!

- Design and Interaction

- Smart Contract Development

- Security Assurance

- Formal Verification

O pus is a dynamic credit protocol, powered by decentralized ledger technology, designed for a fairer, more efficient future. Throughout its history, the banking system as we know it has faced criticism for its centralized structure and perceived lack of customer-centric practices.

This has contributed to unequal access to banking services and financing, perpetuating economic disparities. These issues highlight the need for increased transparency and accountability in the banking industry to ensure fair and equitable treatment for all customers.

Opus may not be the first credit protocol that aims to solve these issues, but it is a state of the art cross margin credit protocol that aims to make every parameter dynamic to achieve safety, fairness, and capital efficiency.

Features

Cross margin borrowing

Dynamic, autonomous risk parameters

Multilayered liquidation engine

MEV-resistant liquidations

State of the art security practices not limited to formal verification

You can do more with your assets than you think.

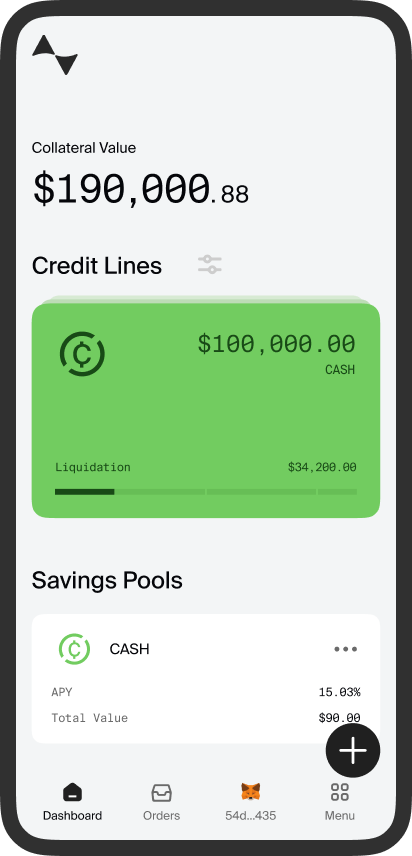

Opus is the autonomous and safe platform for credit and savings.

Use Cases

Standing Out

T he 2020 was marked by the apparition of the first generation of Web3 protocols and products. In the year of 2023, while these protocols continue to iterate toward product market fit, they are weighed down by technical debt, suboptimal security practices, and continue to be afflicted by subpar user experiences.

More recently, shakedowns in the banking industry coupled with Operation Choke Point 2.0 have highlighted major weaknesses with the leading protocols that Opus would have been largely unaffected by.

What Did We Do?

Autonomous and Dynamic

Opus is a trustless cross-margin credit facility on-chain, but where legacy and other DeFi solutions require millions of labor hours to assess and determine risk and its parameters, Opus aims to be fully autonomous, adjusting its parameters in real time in response to liquidity conditions, and through the use of adaptive non-linear controllers. A fair and decentralized credit facility for anything and anyone.

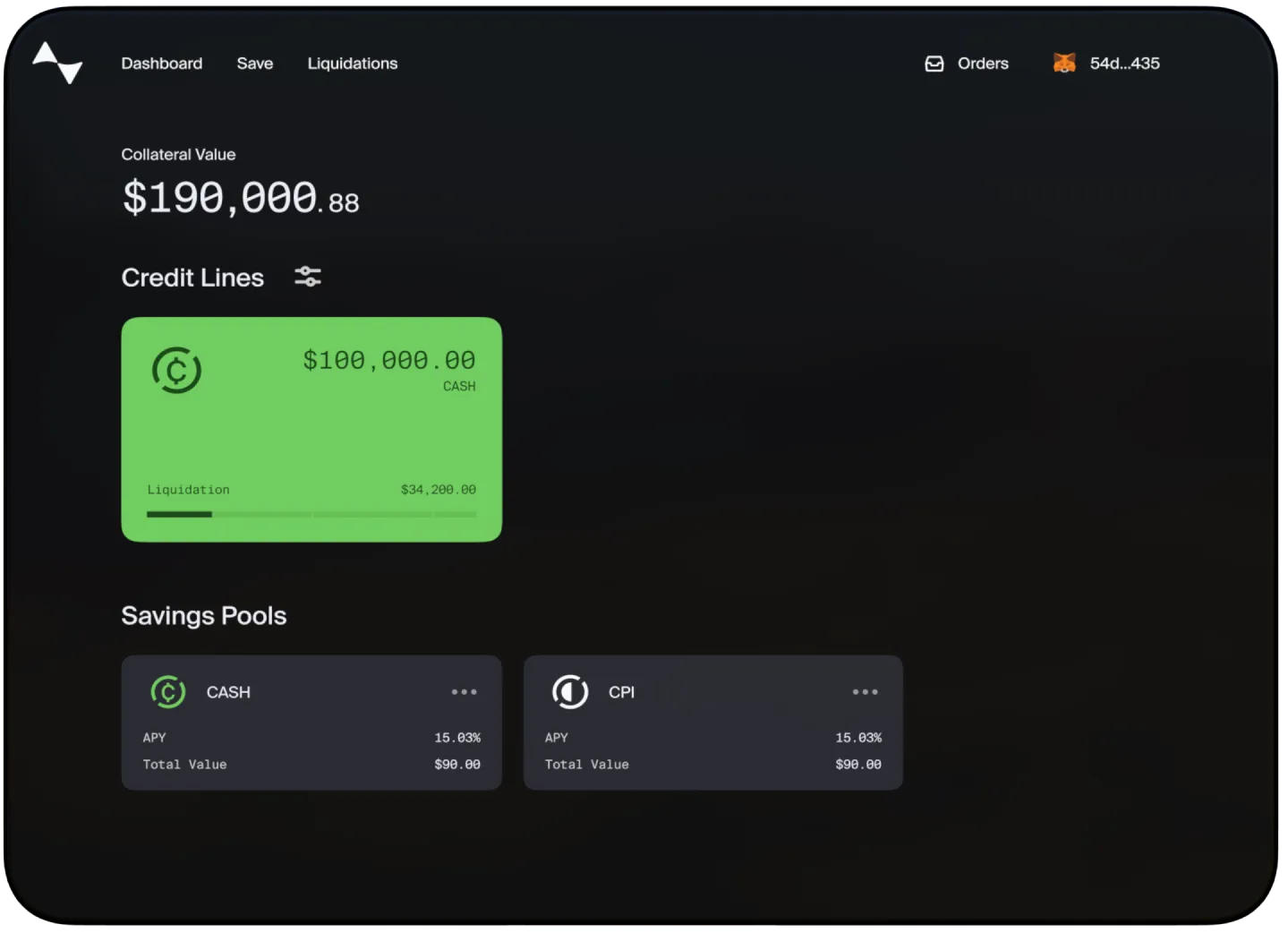

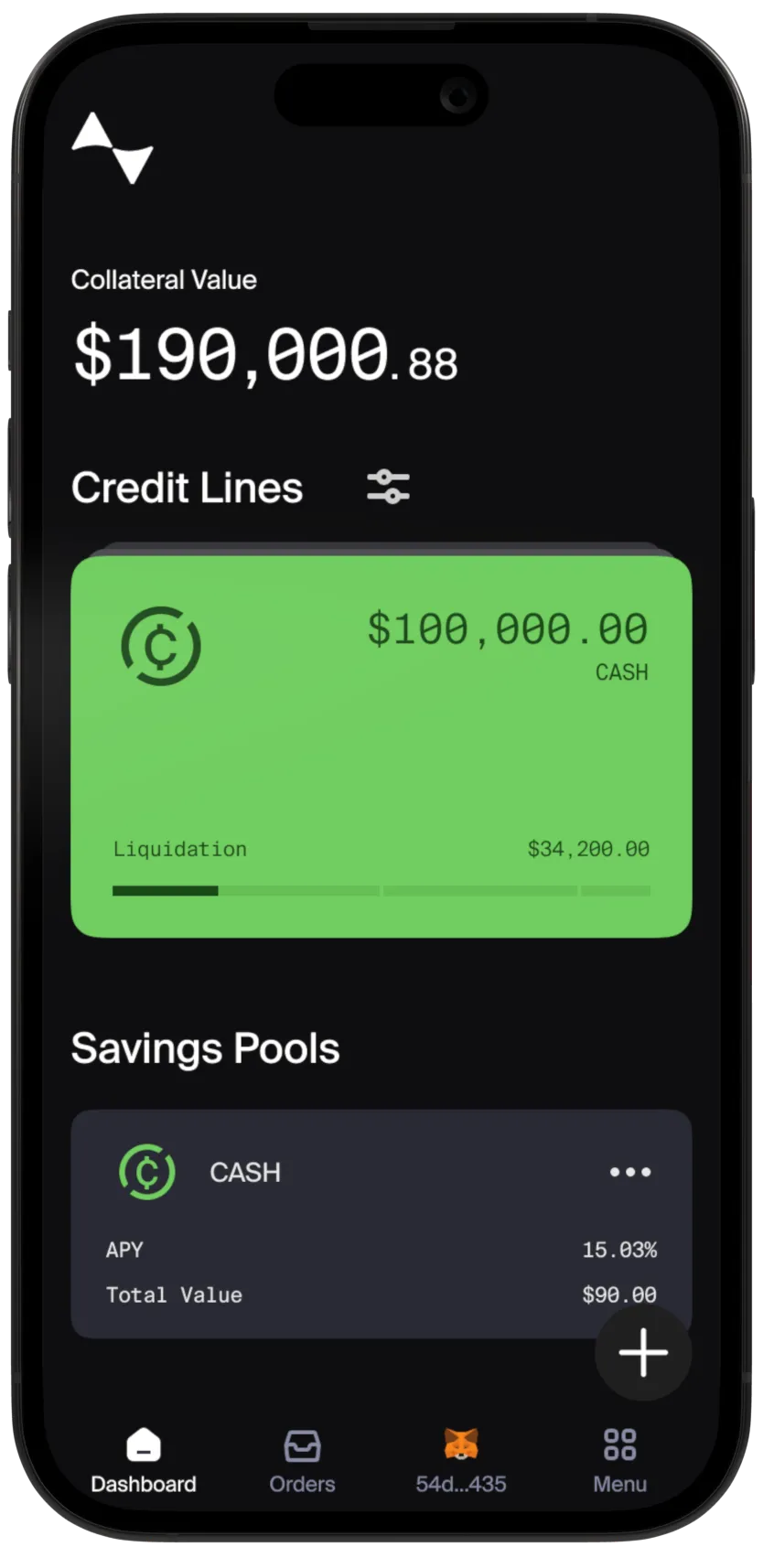

Sublime User Experience for Advanced Users

Web3 UX often demands tremendous amounts of context and know-how, while neglecting risk disclosures. Following industry standard User Research methodology and continuous iteration, Opus's user interface results in the best borrowing experience for expert users without sacrificing accessibility for new entrants.

Security to Match the Stakes

Opus's specification and properties were painstakingly specified prior to its implementation. Afterwards, best-in-class security practices were applied, culminating in formal verification:

- a strong base test suite with unit tests,

- E2E forking tests,

- behavioral fuzzing,

- coverage-guided fuzzing,

- lightweight formal methods via bounded model checker,

- and lastly, mutation testing, the art of bug injection to assess the quality of the test suite

With these, Opus uncovered programming patterns in Cairo 1.0, a novel programming language for writing provable programs, contributed multiple libraries that have gone on to become staples in the space, and is able to boast of one of the highest quality codebases in the space.